Fun Fact 👉: If your employer offers a 401(k) plan, you may also have access to a Roth 401(k). The IRS allows companies that provide traditional 401(k)s to also offer the Roth version.

According to PSCA research, about 86% of employer-sponsored 401(k) plans now offer a Roth version. However, only 23% of employees choose to contribute to a Roth 401(k) plan.

This could mean two things; either most employees are very comfortable with their traditional 401(k) plans and don’t want to switch, or there is still a lot of mystery around Roth 401(k)s.

The biggest question is this: what is the difference between the two plans?

In this piece, we will explore key differences between a Roth 401(k) and a traditional 401(k) plan to help you decide which option is best for you.

What is a traditional 401(k)?

The traditional 401(k) is the original plan, simply called 401(k). With this plan, you make contributions with pre-tax dollars, so you get a tax reduction on your income (specifically, your “modified adjusted gross income”) each year you contribute. You also get tax-deferred investment gains. Contributions go through tax deferral, and you only pay income tax when you withdraw at retirement.

What is a Roth 401(k)?

A Roth 401(k) allows employee contributions with after-tax money. So unlike a traditional 401(k), you don’t get a tax break on your income immediately. However, there will be no tax penalty on withdrawals and investment gains.

You won’t pay any tax on qualified distributions. These are withdrawals made at retirement (i.e., after 59½ years of age) if you’ve had the account for more than five years. Withdrawals made before age 59½ attract a 10% early withdrawal penalty fee unless certain exceptions apply.

Note📝: Roth 401(k)s also allow employer contributions. However, the IRS classifies these contributions as pre-tax, so they will be taxed like a traditional 401(k) when you withdraw. This means you get a mix of Roth and pre-tax contributions if you have a Roth account.

Both retirement plans have similar annual contribution limits which are set at $20,500 with a catch-up contribution limit of $6500 for individuals older than 59½ years. The annual total contribution limit for 401(k)s for both employee and employer contributions is $61,000 for 2022 and $66,000 for 2023.

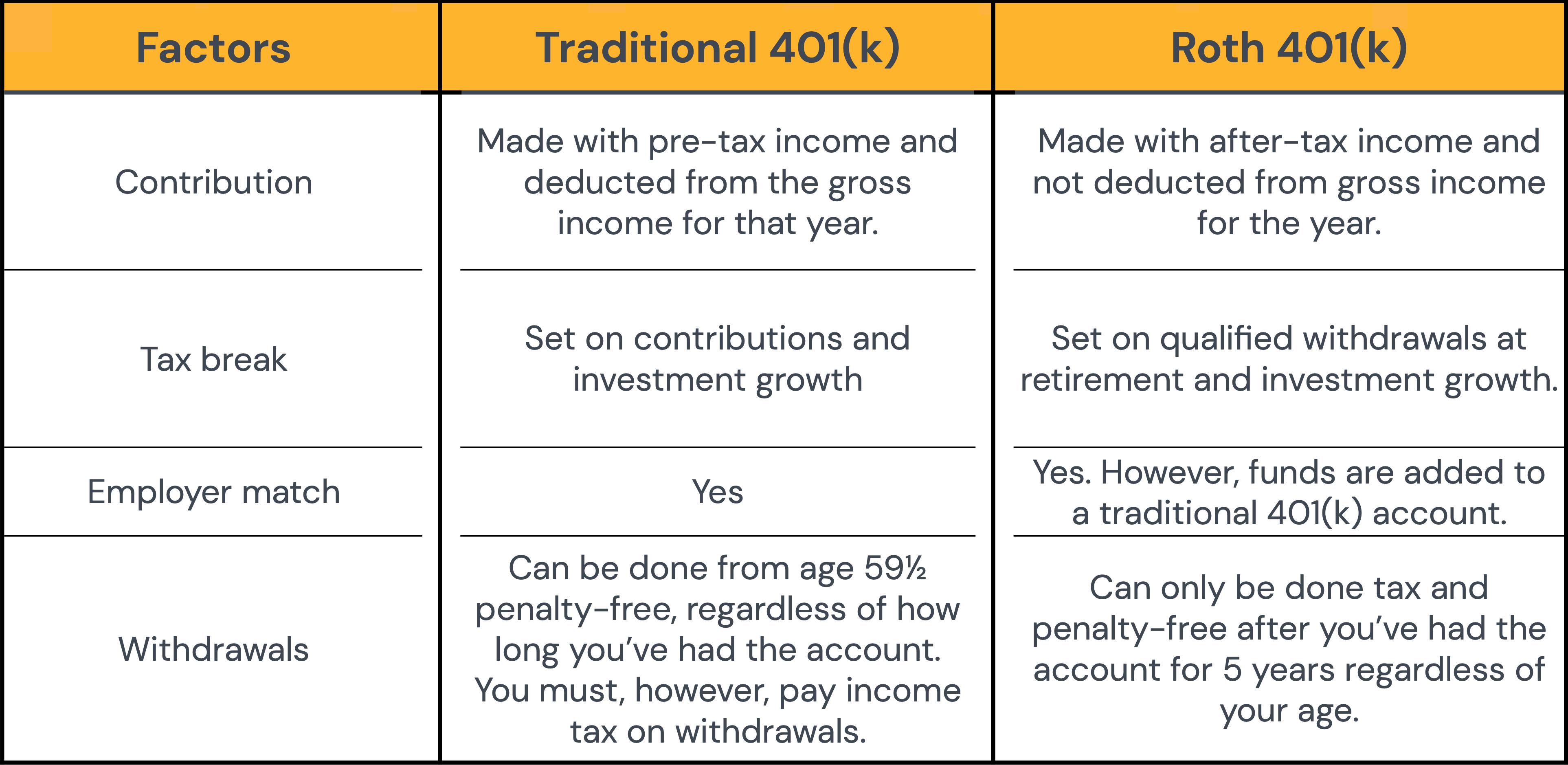

Traditional 401(k) vs. Roth 401(k): what’s the difference?

These are both retirement savings accounts. They mainly differ in how the contributions and withdrawals are taxed. Let’s look at them in detail.

Smart Tip💡: Saving for retirement gives you a great financial cushion for the future. However, emergencies may happen that cause you to take a withdrawal before retirement. The IRS tags this an early withdrawal which attracts a 10% penalty fee and would drastically reduce your savings. If you need emergency funds, consider taking a friends and family loan via Pigeon instead. These loans are easily accessible and don’t have the stiff requirements of other lenders. Pigeon ensures the process is seamless and fast, and all parties are legally protected.

Roth 401(k) vs. 401(k): which is best for me?

The truth is, there isn’t one answer to this question. The plan that will work best for you largely depends on your current financial or tax situation and what you think it’ll be at retirement.

Ask yourself: Do I expect to be in a lower or higher tax bracket after retirement?

If you think your tax bracket may be significantly lower at retirement than it is now, a traditional 401(k) is the better option for you. You get an immediate tax break on those high tax costs when it benefits you the most and can save more.

On the other hand, if you think you'll be in a higher tax bracket at retirement, the Roth option makes more sense as you’ll be shielded from a possible increase in income tax on withdrawals at retirement. It’s best to get the taxes out of the way now and enjoy tax-free withdrawals in the future.

There are other scenarios where a Roth 401(k) may be better than a traditional one and vice versa. Let’s look at some of them below.

When to choose a traditional 401(k)

- Your current earnings are high.

As explained above, if you think your income may drop in retirement, you’ll benefit more from a traditional 401(k) than the Roth version. A traditional 401(k) gives you a tax reduction on your high earnings now, which benefits you more. If you earn less in retirement, you owe the IRS less, and vice versa. You will also be able to save more because most of your income won’t be taxed.

- You need to withdraw within five years.

Roth 401(k)s only allow withdrawals if you’ve been on the plan for five years or more. This means if you open your account when you’re 54, you cannot withdraw until you’re 59. This may not be an issue for employees in their 20s. However, if you’re starting your retirement savings plan later in life and you need to make withdrawals earlier, a traditional 401(k) will serve you better.

- You want matching contributions.

Your employer may choose not to match your contributions to a Roth 401(k) because they do not get any tax benefits from doing so. A good way to handle such a situation is to get a traditional 401(k), save enough to get the full employer match, and switch to the Roth version.

Smart tip💡: If you are moving to a state like Texas or Washington that doesn’t collect state income tax on 401(k) distributions, then a traditional 401(k) may be best for you. This way, you get a more significant tax break when you start taking distributions in retirement.

When to choose a Roth 401(k)

- You’re young, and your current earnings are low.

As we explained above, if your income limits are currently low you’re in a lower tax bracket and consequently owe the IRS less. In this situation, it makes sense to get a Roth 401(k) because you can pay tax at the tax rates you have now rather than pay it later in life when your earnings (and tax bracket) could significantly increase. Also, since you’re young, your investments have a long time to grow significantly tax-free.

- You’re retiring soon and want to leave non-taxable funds to your beneficiary

A Roth 401(k) can play an essential role in your estate planning and wealth management. With a traditional 401(k), your beneficiaries/heirs would have to pay taxes on distributions, which could be a significant amount depending on your asset balance. However, a Roth 401(k) eliminates this requirement and lets your heirs take distributions from your assets tax-free.

Find out more about what happens to your 401(k) savings when you pass away here.

Smart tip💡: If you don’t want to withdraw from your Roth 401(k), you can easily rollover the funds to a Roth IRA (not traditional IRA) to get past the age 72 required minimum distributions (RMDs) caveat, which mandates retirement account holders to take a minimum distribution every year once they turn 72. Roth IRA contributions are exempted from this rule.

- You want more flexibility.

If you're already on a traditional 401(k) plan, it may be smart to also get the Roth version. Having both plans will give you more financial flexibility in the future and help you mitigate high taxation if you end up in a high tax bracket.

Can I use both a traditional and Roth 401(k)?

The answer is a resounding yes! When planning for retirement, many people choose not to have all their eggs in one basket for a good reason. If you can, you should make the most of all the tax advantages of both retirement accounts.

You can make contributions to your Roth 401(k) for the first half of the year to take advantage of the tax-free withdrawals when you retire and contribute to the traditional 401(k) in the second half to enjoy a reduced taxable income. You could also choose to contribute to one plan one year and the other the next year. Your plan administrator will track your contributions to both plans to ensure you get all your tax benefits.

Want to read more related content? Check out some more of our awesome educational pieces below: