If you’re like the 62% of young Americans aged 18-29 thinking about your retirement savings, you probably already know about Individual Retirement Accounts (IRAs) and 401(k)s, which are the most common. Financial advisors are keen to tell you: both of these retirement accounts offer great tax advantages for investing in your future.

So what’s the difference between an IRA and a 401(k)? Both are retirement accounts—the main difference is that a 401(k) is a type of account offered through an employer, while an IRA is an Individual Retirement account—you open it independently of any job.

What is a 401(K)?

A 401(k) is a retirement account set up by employers for their employees. This account operates under the Employee Retirement Account Secure Act (ERISA), and you get several tax advantages for saving.

Here's how it works:

As an employee with a 401(k) retirement plan, you would contribute a percentage of your salary to the account. Many employers also offer matching contributions where they support your savings up to a limit—usually 3% to 5% of your salary or more.

Employers often create a vesting schedule for matched contributions to your 401(k). If the vesting schedule is three years, you must remain at the company for at least three years before the matched funds are fully yours.

401(k) contribution limit

The IRS set the employee contribution limit for 401(k)s to $20,500 with a catch-up contribution of $6500 for employees older than 50. This is an increase from last year's $19,500 limit.

You get a tax break on these contributions as they reduce your annual taxable income. For example, if you make $70,000 a year and contribute $20,000 to your employer-sponsored 401(k) plan, your yearly taxable income will be $50,000.

Investment options

401(k) plans usually consist of a fixed set of investment options you can choose from: often stocks, bonds, or a combination of both. Your 401(k) plan investments will grow tax-free until you withdraw. You can make qualified withdrawals without penalty if you're 59½ or older, but earlier withdrawals come with a 10% tax penalty. Qualified withdrawals are taxed at your ordinary income tax rate.

Types of 401(k) plan

Employer-sponsored 401(k) plans are differentiated based on the kind of tax advantages they provide.

- Traditional 401(k): this is what we described above. Your contributions in a traditional 401(k) are pre-tax. Withdrawals after 59½ years are without penalty and taxed at your ordinary income tax rates. You are mandated to take required minimum distributions (RMDs) from the plan annually once you clock 72 years.

- Roth 401(k): Here, you pay tax on your 401(k) contributions. However, you get tax-free withdrawals from age 59½ onward. You also start taking mandatory qualified distributions after you clock 72 years.

- Solo 401(k): Although most 401(k) accounts are attached to an employer, self-employed individuals can open a solo 401(k) account and make contributions as both employer and employee. This type of plan follows the same rules as a traditional 401(k) plan.

Note: If you change jobs, you can roll over your old 401(k) savings to the new employer's plan or an IRA. You can also keep it as-is. The deciding factor should be simple: which option offers better investment choices and lesser fees? Learn more about what happens to your 401(k) when you quit (or pass away).

Pros of a 401(k)

- High yearly contribution limit

- Free money from employer match programs, resulting in higher total contributions

- Automatic deductions

- No eligibility limitations based on income

- Access to loans

Cons of a 401(k)

- Fewer investment options

- Some employers may not offer matching contributions

- No control over the plan or investments

- Distributions are taxed at normal income tax rates for traditional 401(k)s.

What is an IRA?

An IRA is a tax-deferred retirement investment account that allows any income-earning individual (and spouse) to save for retirement and get certain tax advantages.

The funds are kept by different financial institutions like brokerages, banks, or investment firms. Your investment will grow tax-free in the account until you withdraw at retirement. Unlike a 401(k), you can set up an IRA account independently and don't need an employer to do it for you.

Here's how it works

An IRA can be as straightforward as opening a savings account at your local bank. Many brokerages and investment companies offer IRAs to working individuals with multiple investment options ranging from stocks to real estate.

IRA contribution limits and withdrawals

Like 401(k)s, you can take penalty-free (but taxed) withdrawals from your IRA savings when you are 59½ years or older. Earlier withdrawals that do not qualify as hardship withdrawals attract a 10% penalty.

For 2022, the annual contribution limit for IRA is $6000 for individuals less than 50 and $7000 if you're older, according to the IRS.

Types of IRA plans

- Traditional IRA: This is similar to a traditional 401(k), except it isn't attached to an employer. Here, you can make annual pre-tax contributions to the account (paying from your modified adjusted gross income, reducing your taxable income), and the investments will grow tax-free. However, you will pay the income tax deferral on withdrawal after age 59½. You must take minimum distributions annually after you turn 72.

- Roth IRA: You make Roth IRA contributions with after-tax dollars. This means you don't get a tax deduction for the year you contributed. However, you won't be taxed on withdrawal at retirement. You also won't be forced to take minimum distributions annually and can transfer your savings to your heir tax-free. Note that there are income restrictions set on Roth IRAs by the IRS, so you may not be eligible if you earn a lot.

Pros of IRA

- Available to any income-earning individual

- Multiple investment options and flexibility

- Spouses of account owners can contribute, even if they don't earn.

- Account control

- Easy to set up

- Tax-free withdrawals with a Roth IRA

- No minimum distribution requirement for a Roth account

Cons of IRA

- Lower contribution limit

- Income limits are set on deductions for high earners.

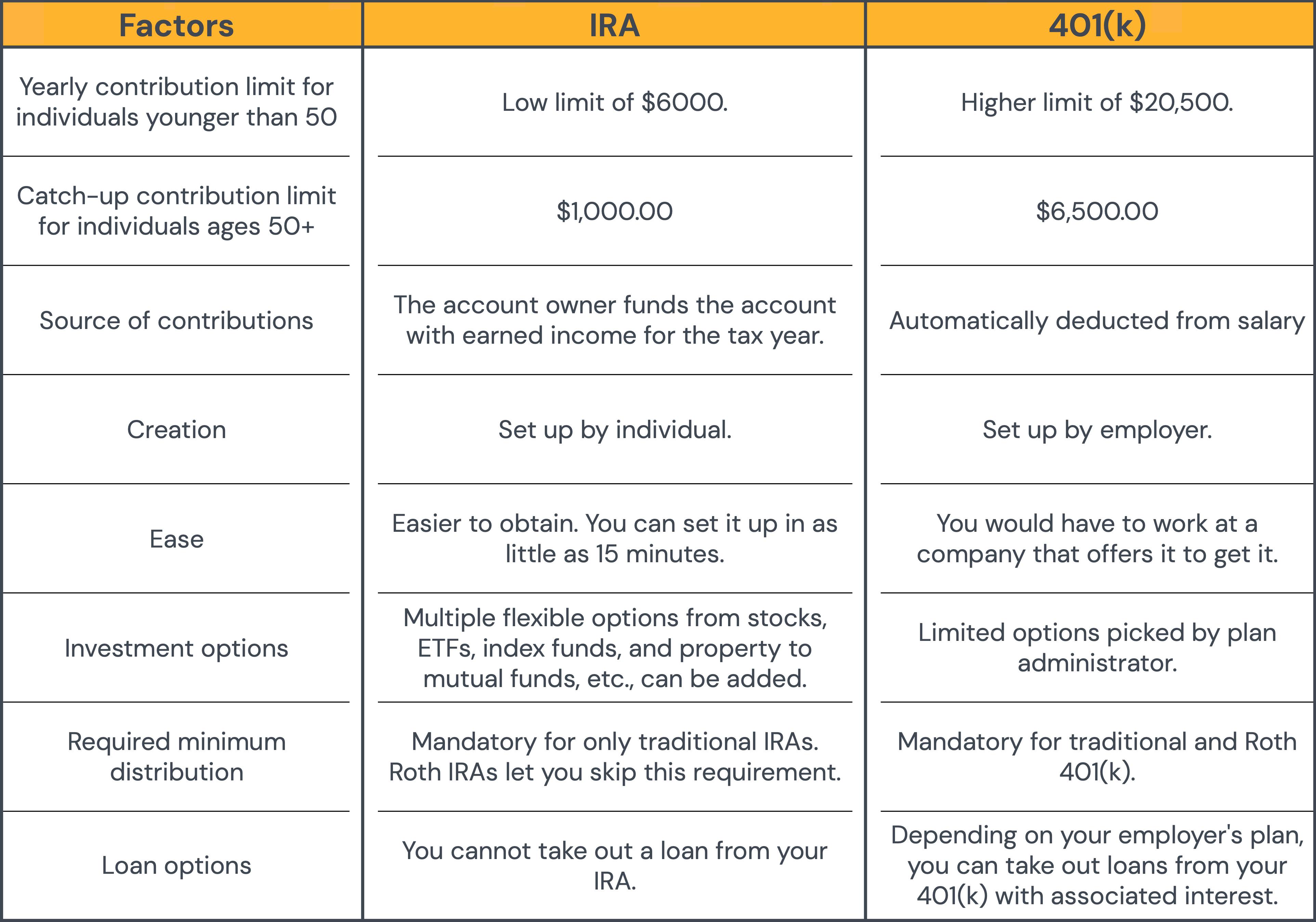

401(k) vs. IRA: What are the differences?

Both retirement accounts are great options and will help you secure your future financially. However, you should be aware of key differences between an IRA and a 401(k).

Let's compare them directly!

Note: Technically, you cannot take out a loan from your IRA. However, you can withdraw money from the account to buy a house or car. This will be a taxable withdrawal if it’s done before retirement, and the 10% early withdrawal penalty will apply. However, if you can repay the funds to your IRA within 60 days, you may avoid tax deductions and IRS penalties.

Smart tip💡: Taking out a 401(k) loan or withdrawing from your IRA early is risky. The IRS treats the loan as an early withdrawal if you don't repay it in time. You may also get stuck with steep penalties and tax consequences. If you have a financial emergency, a better option may be to get a loan from a friend or family member via Pigeon. These interpersonal loans can help you avoid the potential penalties, credit inquiries, and other requirements of traditional lenders, while still structuring the loan properly to avoid headaches during tax season.

IRA vs. 401(k): Which is best for me?

Why choose one when you can have both?🤷♀️ Yes, you can have an IRA and a 401(k) as long as you meet your employer’s eligibility criteria and do not exceed the contribution limits set by the IRS.

If you have a 401(k) plan, prioritize your employer's contributions. Suppose your employer offers 6% matches to your contributions. That's a guaranteed return on your investment already. You should try to get the full match by saving more. Once this extra money is vested, you can use it to fund an IRA either via your employer (if it is offered) or by rolling it over to a new IRA account that you set up. As explained earlier, the funds in your 401(k) reduce your annual taxable income, and your investment growth is not taxed either.

A 401(k) lets you contribute more money annually with pre-tax dollars than an IRA. However, an IRA offers more extensive investment options that may be better than what your 401(k) plan offers. The choice between these types of accounts will rest on your investment/savings goals.

Your decision may also depend on your current and estimated tax bracket.

- If you think you’ll be in a higher tax bracket at retirement, then a Roth IRA may be the best option for you. You get to pay taxes on contributions now when the rate is lower and then get tax-free withdrawals later.

- If you expect to be in a lower tax bracket at retirement, a 401(k) is best as you get the tax break on your high income now, when it matters more, and pay tax on withdrawals at a lower rate later.

Smart tip💡: If your employer does not provide company matches, open an IRA first and get all the available benefits. You'll get access to multiple investment opportunities that will grow your portfolio. After getting all the benefits of a traditional or Roth IRA, you can start contributing to your employer-sponsored 401(k). The tax benefits associated with 401(k)s are a great reason to direct a percentage of your earnings to it even if you prefer an IRA.

The Bottom Line

Choosing between a 401(k) or an IRA is an important personal finance decision and one you shouldn't make without adequate research. Your retirement plan will set the course for your future. Luckily, either one of these two options (or both!) will get you off to a great start.

Want to read more related content? Check out some more of our awesome educational pieces below: