When startups fail, it’s not out of thin air. There’s always a reason behind the scenes, and the most common is a lack of cash. In fact, 38% of startups that fail do so because they run out of money, according to the CBInsights 2022 Why Startups Fail report. 💡

It’s a key reason that startup founders seek seed funding and business loans. If you’re in the startup stage, the right business loan for your type of business can help solidify your success (no, it’s not a panacea, but it helps 🤷🏽♀️).

Before securing business funding of your own, know your options and how to prepare for the type of financing you choose.

Types of startup loans + how new business owners use them

Outside of venture capital, angel investing, and crowdfunding platforms, here are some of the most common loan options for startups:

Are there business startup loans specifically for minorities?

Startup business loans for women, people of color, disabled people, and other marginalized groups are available to increase equity in the business landscape. ✍🏾

Small business owners may want to check out nonprofit microlenders, which receive SBA microloans (a type of small business loan) and dole them out to businesses themselves, often choosing borrowers through a focused lens. These microlender intermediaries can grant fixed-interest loans up to $50,000. Eligibility depends on the intermediary lender’s requirements.

Outside of these intermediaries, the SBA does not directly provide loans for minority entrepreneurs—but it does offer counseling, training, and prioritization for awarding contracts to certain groups.

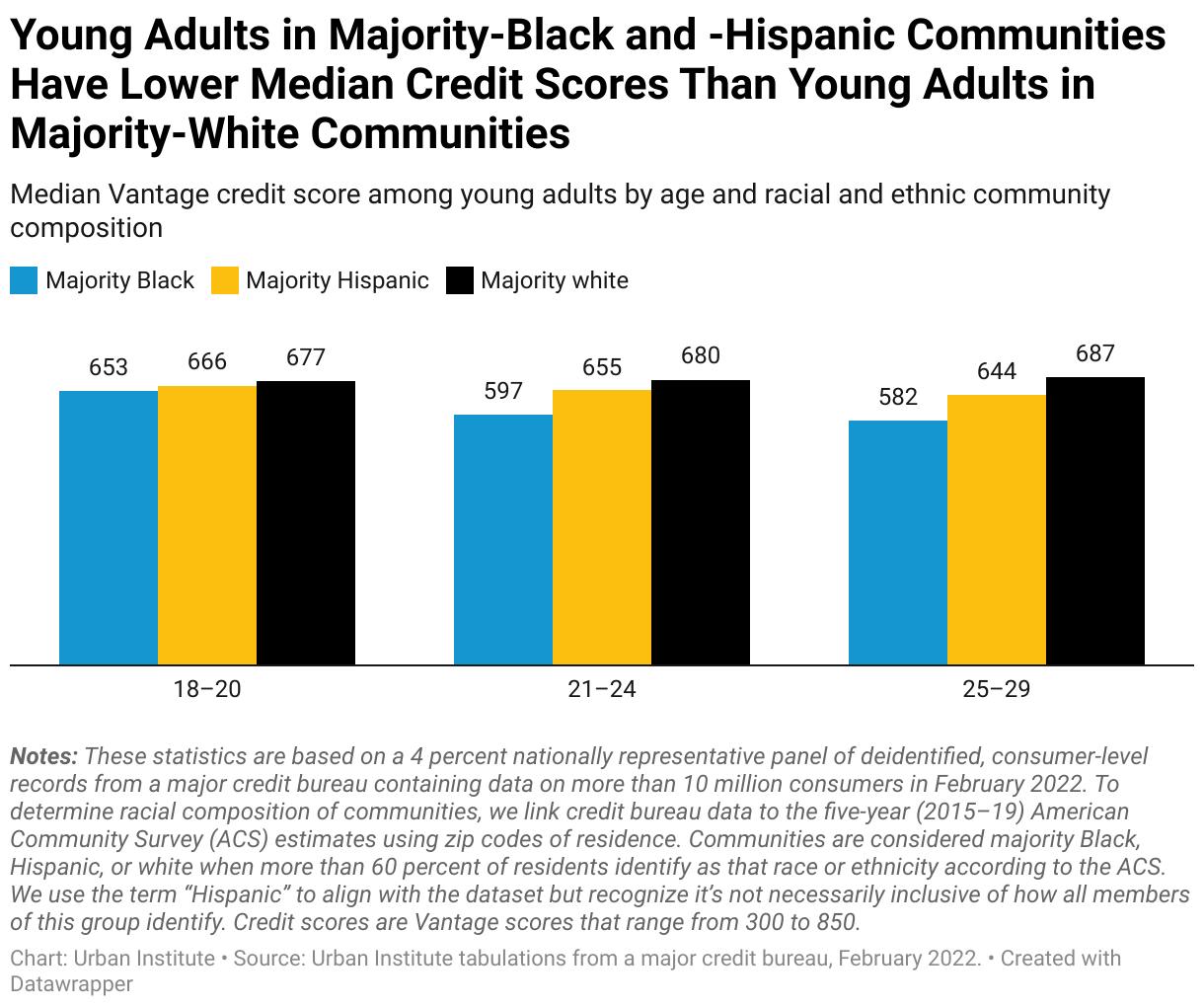

Racial disparities in credit scores can limit funding options for some startup founders. According to a study by the Urban Institute, Black adults ages 25–29 have an average credit score of 582 (generally considered “bad credit”) while Hispanic and white people in the same age group have scores of 644 and 687 respectively. This is a direct result of racist lending practices that have pervaded American culture for centuries. 💯

With more online lenders available today, many of which are algorithm-driven, marginalized groups are able to find a suitable business financing option—even with a subprime or thin credit history.

Another option, lending between friends and family, is also gaining steam and avoids the creditworthiness obstacles altogether. For Pigeon, which facilitates loans between friends and family, 70% of users are Black, Latino, or Asian. These communities may face disadvantages, but they have a legacy of helping one another.

Small business grants can also be helpful for minority entrepreneurs who need a jumpstart. Review grants.gov, the USDA Rural Business Development Grant, the National Association for the Self Employed Growth Grant, Minority Business Development Agency opportunities, and local-to-you organizations to find one that fits the bill.

Checklist: How to prepare for a startup loan

Improve your chances for a startup loan and get ready for a seamless loan application process with this checklist:

- Trim existing debt. If your business already has too much debt, you may have trouble securing additional financing.

- Shore up your credit score. If you struggle with poor credit, there are ways to increase it incrementally. Open up a business credit card, use it (but not too much), and pay it off in full each month. You can also negotiate net-90 terms with vendors to get started. This can help increase your loan amount and decrease your interest rate. Business credit scores are different from personal credit scores, but startup founders with little to no business credit can also benefit from improving their personal credit while they’re at it.

- Assess your options. Don’t be afraid to ask lenders questions, including whether you’re a qualifying candidate and, if not, what you can do to change that. 🙋🏼♂️ You’re their potential customer and hold a lot more power than many traditional lenders may lead you to believe. Startups FTW!

- Create a detailed business plan and explanation of business performance. This could make your business more attractive and trustworthy to potential lenders. Plus, 18% of business loan applications are declined because of weak performance from the outset. If you have annual revenue and other relevant metrics, include them. If not, create projections. 📜

- Gather your personal and business information. This means your employer identification number (EIN) or social security number (SSN), business entity formation paperwork, the aforementioned business plan, and any other pertinent information the application may request.

- . This term refers to the document which will contain all the information about your loan. It’s important to understand what it covers and how it’s structured.

Bottom line on scoring startup funding

With so many types of loans and funding options at your fingertips, it’s never been a better time to be a startup founder.

In many cases, startup financing enables businesses to embark on an upward trajectory instead of stalling out. 📈 Whether your own business’ source of funding is a short-term loan, long-term loan, or something in between, take your financing options seriously—because it really can make all the difference.

Want to read more related content? Check out some more of our awesome educational pieces below: